|

Small and medium sized businesses are faced with challenges and employees issues that the fortune 500 companies of the world don't have to deal with. That list alone is a blog post by itself. But rest assured among the things on that list is employees asking to borrow money or to get an advance on their paychecks. If you’ve been there you can clearly remember the extreme discomfort that fell upon you when the employee spoke those words.

It doesn't matter how compelling of a reason the employee has or how much you like them, it's still uncomfortable and awkward. It's even more so if you don't have a policy in place that spells out the company's response. Read that again dear friend, the company's response. The employee is not asking you for money, he or she is asking the company for a loan. How well you can make that distinction will be very helpful as you consider what you’ll do when it happens.

So why do employees ask small business owners for loans in the first place. Well the obvious reason is that they need money. But don't employees who work for large corporations have times when they run short on cash too? Of course they do. So the real question is why do employees feel comfortable asking small business owners for loans? While it may be perplexing for us, it kind of makes sense from an employee perspective.

In the mind of the employee all of these reasons make it “ok” to ask you for a loan. Now the question is what are you going to do?

Of course you can always say yes. That's the easiest response. And if that works with the core values of your business, then that choice is yours to make. However if you don't want your business to turn into always bank or payroll advance company, but you also don't want to come across as caring, what are you left to do? Luckily you have options to show compassion while at the same time maintaining the financial health of your business. The alternatives below work well because they may help employees meet a financial need in a crisis, provide them with skills to better handle money and involves them in the process of helping themselves and others.

START AN EMPLOYEE FUNDED EMERGENCY ASSISTANCE FUND

To take the pressure off your small business when it comes to being asked for financial assistance from employees your small business could set up an employee funded Employee Emergency Assistance Fund. An employee funded Employee Emergency Assistance Fund is a pretty much an internal charity that provides money to employees who are in need. The fund can be employee sponsored and managed by a committee of employees. Employees can choose to participate through payroll deductions and that money is set aside for use when employees have a qualifying request. Usually requests are limited to employees who have contributed to the fund and for request types that the committee has previously approved. Some typical requests might be:

CONNECT THEM TO COMMUNITY RESOURCES

Not all employees are going to want to contribute the the benevolence fund. It also may not work for every small business. So another option would be to do some research and create a list of local charities that offer crisis financial assistance. These organizations are resources to have on hand in the event that an employee has a financial need. These charities are equipped to provide financial and other assistance to help with the underlying source of the problem. Some charities that may be in your area may include:

HELP EMPLOYEES TO BECOME MORE FINANCIALLY SAVVY

The unexpected could happen to everyone, but sometimes financial “crises” happen due to lack of budgeting and saving. Most people never receive formal financial literacy education and may struggle with making wise decisions when it comes to money. As a small business owner how do you help your employees grow in this area? You can help with this development by partnering with organizations to host financial literacy courses for your employees, or sharing these opportunities with your employees when they are hosted elsewhere.

The United Way offers Real Sense, which is a program that teaches adults about finances. They are always looking for business partners and for businesses that want to offer the program to their employees. They also have other resources both online and printed that would be helpful for employees who need help getting their finances together. United Way Resources: My Smart Money Real Sense

These options are good alternatives to making loans to employees. A combination of all three would work well to preventing crisis situations through education, and meet immediate needs through financial resources. What is your small business’ policy on making loans to employees?

0 Comments

Leave a Reply. |

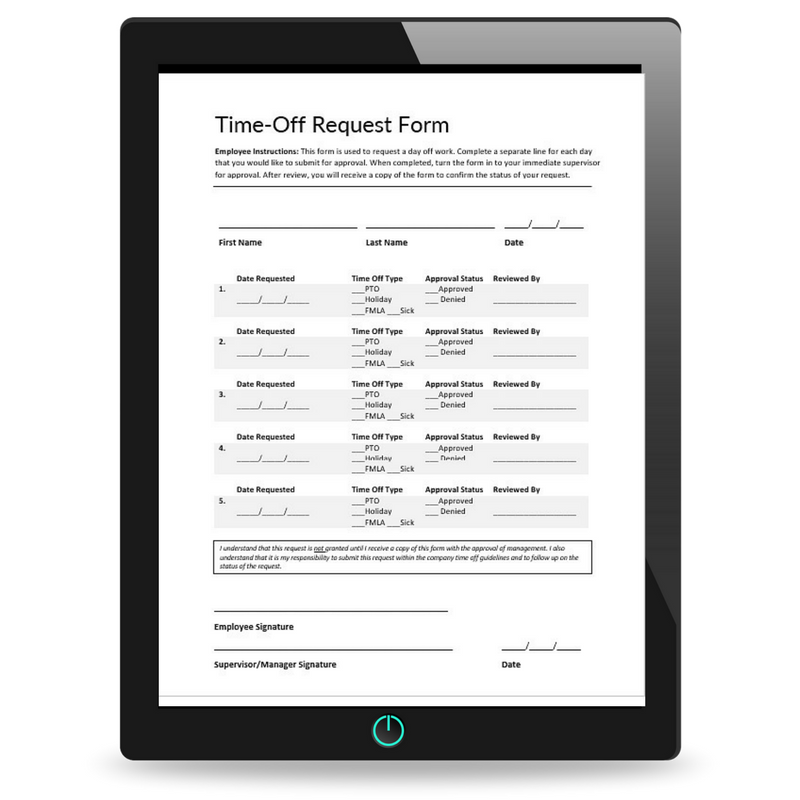

On SocialLATEST WORKSHOPSmust reads!HELPFUL RESOURCESTIME OFF REQUEST FORM

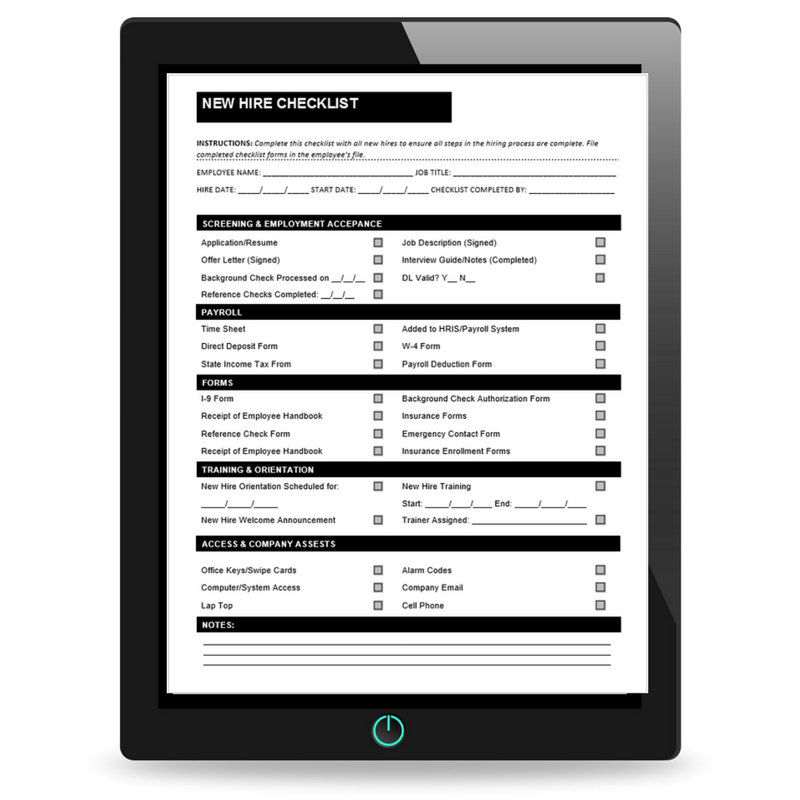

NEW HIRE CHECKLIST

INTERVIEW PLANNING WORKBOOK

|