|

Not to get all personal, but let me ask you a question. How do you pay your employees? Many small businesses have been slow about adopting direct deposit. I’m not sure why because, direct deposit is awesome. Honestly, it is. If you don’t use direct deposit your other options to pay employees are, well just not that great or convenient.

If you already use direct deposit, you still have reason to stick around for this post. While we will talk about options to pay employees and then about what makes direct deposit so awesome, there is a pretty useful freebie too. I’ll give you a hint. It’s something that you’ll find helpful for those employees who come to you lost about how to set up direct deposit because they don’t have or want a bank account. Oh yeah, you’re gonna want it, so just read on.

Now, for those of us who haven’t yet got on the direct deposit bandwagon. If you’re not paying employees by direct deposit, how are you paying your employees. Well, a few alternative means to pay employees may be cash or check. Let’s examine those for a moment.

Ways to Pay Employees Cash Not only is this sketchy, it just screams, “Hey, world, I pay my employees under the table.” That’s not the message you want to send. In addition to not looking on the up and up, it requires the extra tasks of going to the bank, making cash withdrawals, then counting and separating cash for each employee. There are also the security risks. Suppose the money is stolen or lost before being distributed to employees? You’ll still be responsible for paying employees. Then there is the security risks for your employees with carrying around that much cash. And what happens if an employee disputes they were paid? You don’t really have “proof” of what you paid them or when or that you deducted taxes. It’s just a hassle and not the smartest move. Checks And by checks, I mean payroll checks not pulling out your personal or business checkbook and writing away. No. We’re talking about payroll checks from a payroll company. When you sign up for a payroll company, which I highly recommend that you do, you’ll have the option to have paper checks made a pay through direct deposit. If you pay by check, you’ll receive the checks by mail and you have to distribute these checks to employees. This maybe easy if your employees work all at one location. But checks still aren’t the perfect option. You have to wait for employees to cash checks. You have to deal with holidays, vacations and other things that disrupt the normal distribution. Oh and that one employee who always loses their paycheck. Uhm, reprinting checks isn’t free. Why Paying Employee Direct Deposit is the Best Option

You don’t have to be there for employees to get paid.

Freedom....sweet freedom! With any other payment method, you have to be there to distribute the payment. So what if you want to take a vacation and it falls on a pay day? Cancel that. You have have to be around to pass out payroll checks. With direct deposit, your employees get paid no matter where you are. Even if you are on vacation. This is also a benefit for your employees. If they are off work or out sick on a pay date, they can still receive their pay on the pay date. Easier and faster access to funds. Employees this is a huge win. There is not waiting to pick up a paycheck and go the bank. No check holds that their bank may impose. They have instant access to the funds on the date of the deposit in most cases. And they save time.

See, direct deposit is awesome and easy for you and employees. Usually setting up direct deposit can be done with a few clicks through your payroll provider. However you will need to get employees to enroll so that you can get their banking information. That’s as simple as creating a direct deposit form for employees to fill out. You can create your own, or grab one here that is ready to use.

Alright so I promised a useful freebie right? Right? Well, here goes. A common objection to direct deposit is that some employees may not have a checking or savings account. The good news is that a traditional checking or savings account is not needed for direct deposit. There are many options of pay cards that allow employees to have their paychecks deposited and they can then use the card to make purchases, get cash at ATMs or shop online.

Sharing this information with employees may give them an alternative, but if they are not familiar with these products they still may be staring at you for further guidance. So when that happens, I did some research on prepaid debit card options. Keep in mind I have no connection with any of these products nor do I endorse any of them, but this handy download can give your employees some basic information to start their research. Always encourage your employees to make an informed decision based on their financial situation and that this handout is informational only. They may want to consult a sources like bankrate.com for help on deciding on an option. But now that I’m done with the disclaimer you can click the picture above to print your Alternative Direct Deposit Options sheet.

0 Comments

Leave a Reply. |

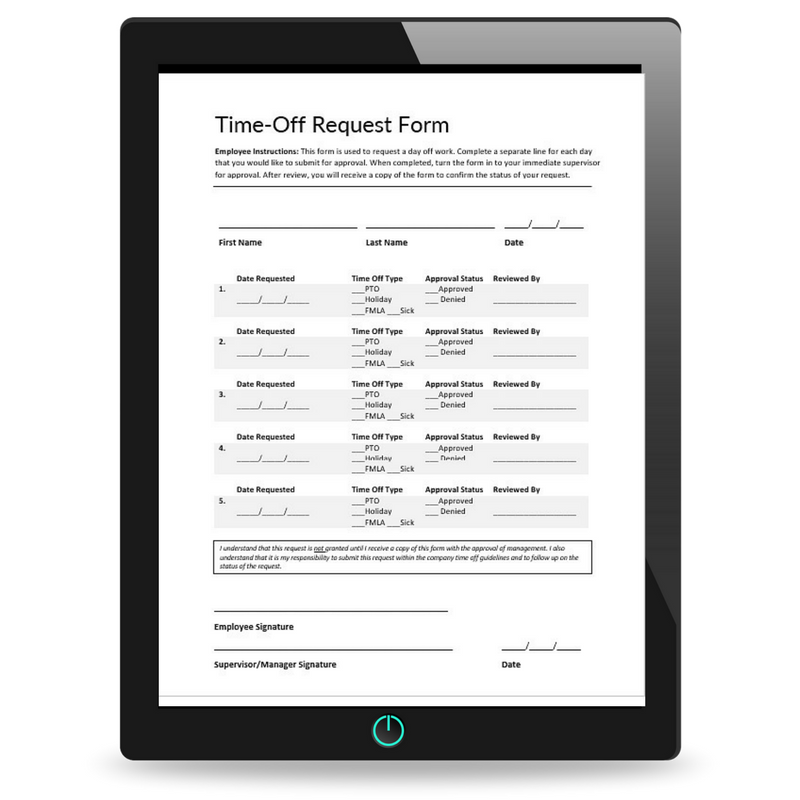

On SocialLATEST WORKSHOPSmust reads!HELPFUL RESOURCESTIME OFF REQUEST FORM

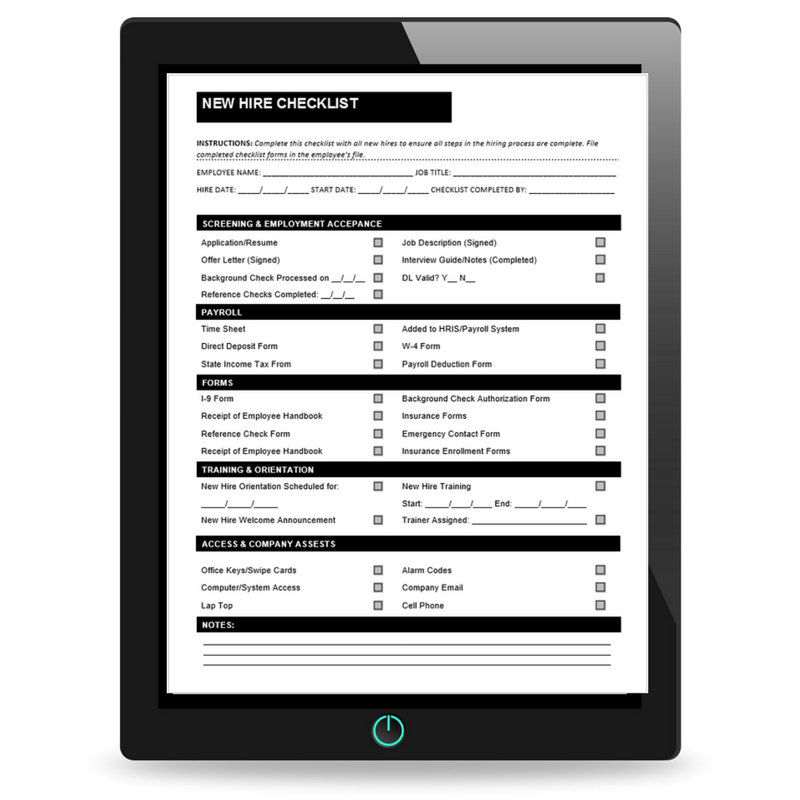

NEW HIRE CHECKLIST

INTERVIEW PLANNING WORKBOOK

|