W-2 Forms and Terminated Employees: 3 Ways to Decrease Returned Mail (....And The Headaches)1/18/2016

Tax season is here. I hope you're still with me after that little announcement. But aside from your personal tax situation this means that as an employer you have to distribute W-2 forms to your employees. This form allows them to file taxes. For most employees that means a tax refund, so by now I'm sure you've probably received some questions as when they will get those forms in hand.

Generally employers have until January 31st to mail W-2 forms. Employees, current or past, don't have to receive them by this date. But the W-2s will need to be post marked by the 31st. The good news is that your payroll company will prepare the W-2 forms for you to distribute (for a fee of course) and for your current employees it's not a big deal to distribute them. For current employees its as easy as having them pick the forms up from your office of mailing them out. {It's a good idea to verify your employee's mailing address before sending the W-2 forms by doing an employee information update. Here's a blog that I wrote all about how to do that: How To Conduct an Employee Information Update + Tutorial + Resources.}

But what about terminated employees? How can we make sure that they receive their W-2 forms in a timely manner? Well, unless you are lucky enough to not have experienced any turnover last year, this is something to think about. Of course you could always just drop the form in the mail to the address you have on file, but that may not be the solution because:

So what can we do to not drive ourselves crazy and not waste money or time? Well, my friend, this is nothing a little pro activity can't handle. Here are a few things you can do help ensure that your terminated employees receive their tax documents on time with the least amount of wasted postage. Be proactive and do an employee information update

The best course of action is to plan for an information update for all employees, active and terminated. {Read about that here: How To Conduct an Employee Information Update + Tutorial + Resources.} This update, if done early enough will ensure that you have accurate mailing address for all employees. Or it will help you to identify the past employees who might be challenging to contact and you begin further outreach.

Have terminated employees pick up their W-2 forms

Another way to prevent those W-2 forms from being returned in the mail is to request that your terminated employees pick the forms up from your office. Simply send an email to employees who left the company the previous year and inform the that their tax documents are ready for pickup. Also remind them of your business hours. Its a good idea to have the employee sign a log stating that they picked up the form. You can print a terminated or inactive employee report from your payroll provider. Just export into a spreadsheet and make a few changes to create and pick up log. This step will you give proof that the employee was given a W-2 form. For any employees who do not pick up their W-2 or respond to your email with an updated address, go ahead and mail them on or before the deadline.

Call terminated employees to verify their address

Calling past employees to verify their address before mailing their W-2 form is a perfect task for an assistant or temporary employee. Or if the list is short, you could take a half hour and knock out this task. Most payroll providers have reports for employee contact information which can be printed and exported into a spreadsheet. If there are differences, go ahead and make the updates then mail. If this is done after you have received the W-2 forms from your payroll provider, the W-2 will have the incorrect address. Just place it in larger envelop or use a label with the correct address. This effort is well worth it to prevent mass amounts of returned mail.

So there you have it. A few simple ways to ensure that your terminated employees receive their W-2 forms in a timely manner. For those past employees that you just can't reach, (there may be a few), we have no choice but to mail them so just go ahead and drop them in the mail. But by taking a few extra steps, you've drastically decreased the numbers that will boomerang back to you.

3 Comments

Cathy D.

6/12/2023 12:00:28 am

Printing the forms to give directly to employees is a great idea. Life got so much simpler when my start-up invested in software that allows us to print W-2s on pre-printed forms: https://1099-etc.com/payroll-software/w2-and-1099-forms-filer/.

Reply

James S.

12/17/2023 08:03:56 pm

Tax season can be a real drag. It's good when your software cuts down the time you spend on certain duties to make way for other unavoidably long ones. I recommend finding a program that offers an SSN verification file: https://1099-etc.com/payroll-software/w2-and-1099-forms-filer/. It makes your process incredibly efficient when you need to verify an employee's Social Security Number with the SSA.

Reply

Leave a Reply. |

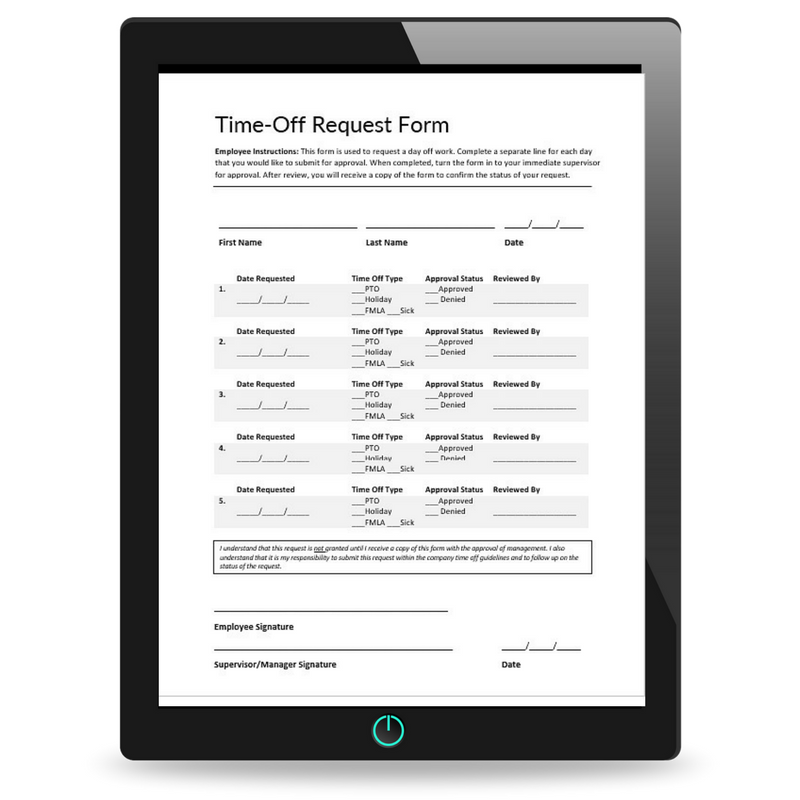

On SocialLATEST WORKSHOPSmust reads!HELPFUL RESOURCESTIME OFF REQUEST FORM

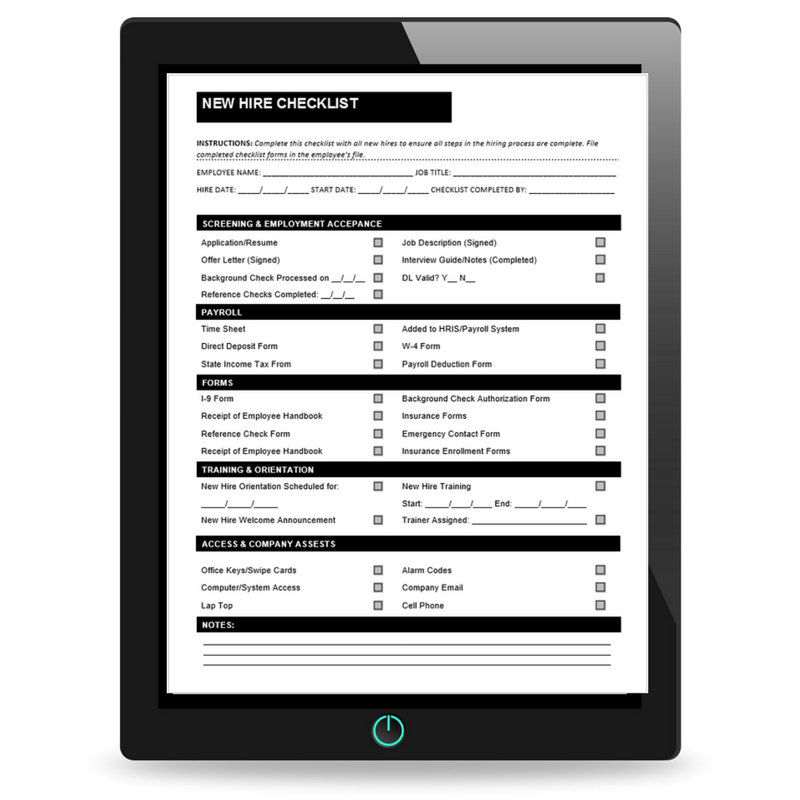

NEW HIRE CHECKLIST

INTERVIEW PLANNING WORKBOOK

|