|

You've spent months, weeks, days going through applications, diligently conducting interviews to find the right candidate for your first hire. Yay you for being an awesome business owner and carefully navigating through the recruiting and selection process. The ultimate reward is that finally, you found the one! A good employee to add to your business that is. You're excited. It is a huge milestone in your business. Even more exciting is that you finally get some much-needed help. I know the happy dance is in full effect. But before you raid Office Depot for office supplies to set up their workstation, and schedule their first day of work, there is something else that you have to do. There is some paperwork that needs to be completed to make it all official in the eyes of the government. I imagine it is not a huge surprise that the government requires some documentation of new employees. Of course, you have probably filled out various employment forms during your experiences as an employee. But now you are responsible for making sure you get the new hire documents right. The is no scary HR lady conducting new hire orientation. But, you're not on your own. I'm here for you. I'm going to walk you through the required Federal forms and some additional forms you may want to include in your standard new hire forms. Since we want to stay on the government's good side, (That's a really good idea by the way.) let's tackle the required government forms first. The good thing is that there are only two, the I-9 form and the W-4. Let us get into some details shall we? Getting to Know the I-9 FormFirst, get yourself a copy of the form. It's free! You can download a copy here [ Download Copy of I-9 Form Here]. The form does have an expiration date. The expiration date is printed on the form. It is no longer valid after this date. You can always refer back to this website to download an update form. For that reason it is a good idea to bookmark the USCIS website for future reference. [ Click to add to your book marks.] ,The I-9 form is a mandatory form. All employees hired after 1986 (So your new hire is included.) is required to complete this form. The purpose of the document is to establish that the employee has a legal right to work in the United States. To accomplish this goal, the government requires you, the employer to verify the identification of all new hires. Acceptable forms of identification are listed on the I-9 form. Generally the employee has three days after their start of work to present the acceptable documentation. Employers are also required to maintain a record of the form even after the employee's termination. Or what happens? I'm not exactly sure. But you definitely don't want I.C.E (Immigration and Customs Enforcement) camped out at your office. FREE I-9 TrainingSo the I-9 form is very important. That means it is important that you fully understand how to properly complete the form. While not difficult, it is not something that you just wing without some solid training. I was in the process of creating an amazing I-9 form training for you when I found this very thorough and free webinar presented by the USCIS (That stands for the United States Citizenship and Immigration Services. Just another nugget to tuck away for trivia night.) Since this agency oversees this area, it would be pretty awesome get the training directly from the source. I previewed the training for you and here is what it covers........ In this training you will learn:

Very comprehensive! The training is just a little over 20 minutes. You'll gain some hiring rock star coolness by taking the time review the training and saving the training link for future reference. Here is a link to the same training on the USCIS website if you have problems viewing the video on Youtube. [ Direct Link] It's All About Taxes....The W-4 FormThe W-4 form is an IRS form used to determine the amount of money to withhold for Federal Income taxes from the employee's paycheck. On the W-4 the employee can claim allowances, request additional withholdings, or claim exemption from withholding. Claim allowances: Generally the more allowances the employee claims the less money that will be withheld for Federal Income Taxes. Some experts recommend employees taking one deduction for themselves and then one deduction for each dependent. Depending on how much the employee earns, the number of allowances taken can result in zero dollars being withheld from their paycheck. Employees may not be aware of this and ask why there are no withholdings. This is generally the reason. Request additional withholdings: The employee can choose to have additional Federal Income Taxes withheld. This is often in an attempt to prevent paying to little in taxes throughout the year and having to write the government a check at tax time. Underpaying in taxes can happen to an employee that works two jobs or they are married and their spouse works. The worksheet on the W-4 form does not take into account this additional income which in fact, could put them in a higher income tax bracket. Exempt from Federal Income Tax Withholding: Only a small number of employees may be exempt from having Federal Income Taxes withheld from their paychecks. These are usually employees who earn less than $8,000 per year. Their incomes do not meet the threshold to require Federal Income Tax payments. The best part of the W-4 form is that the employee completes the form on their own. It is their responsibility to complete the form based on their financial and tax situation. Often employees will ask for assistance completing the form. I always caution against it. There are plenty of resources available online to help them make the right decision or they can consult a tax professional. The form can be updated at any time as often as the employee wants. So if their situation changes or they want to select different options, all they need to do is complete a new form. The employer obligations for the W-4 is to provide it to the employee, enter their elections into the payroll system for proper withholding and maintaining a record of the form. Here are a few resources for you:

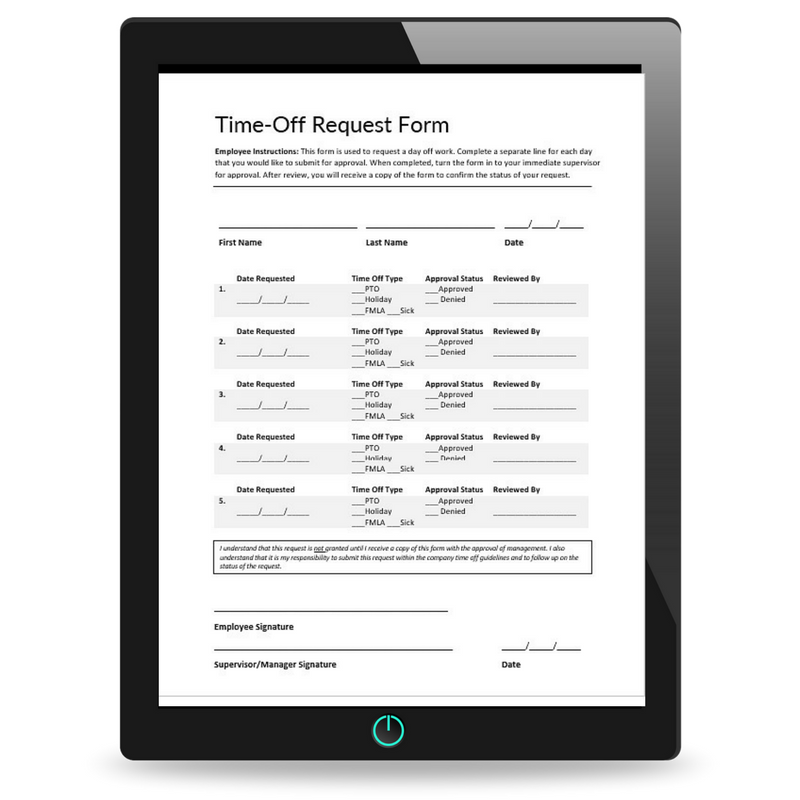

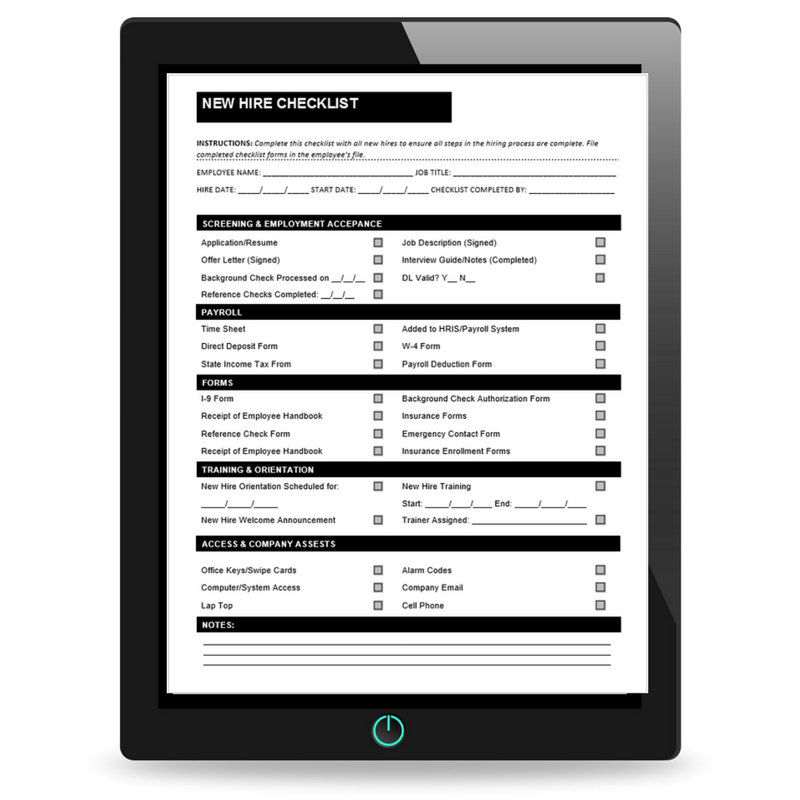

State Income Tax Withholding While we are on the delightful subject of taxes, if you operate in a state with state income taxes there is an additional form to complete. That is an additional withholding form that your new hire will need to complete. Since there are only seven states without a state income tax, chances are good that a state withholding form will be required. To check if your state has a state income tax and grab a copy of the form here. [Click here for a list of states with income taxes and the required withholding forms.] There you have it, a list and overview of the mandatory forms your new hires should complete to make the hiring decision official. That will, of course, make for a bare bones employee file. There are some forms to fatten up that file and gather a more well-rounded employee profile. The Work Playbook store has a selection of employee forms that you may consider adding to your new hire forms. The forms are ready to use and can be downloaded instantly.

Comments are closed.

|

On SocialLATEST WORKSHOPSmust reads!HELPFUL RESOURCESTIME OFF REQUEST FORM

NEW HIRE CHECKLIST

INTERVIEW PLANNING WORKBOOK

|